Did you hear about the new eCommerce EU VAT rules?

Selling online is an endeavor that comes with many rules, regulations, legal limitations, taxation, and other rules one must strictly follow in order for their business to conduct its activities in compliance with the law. However, many entrepreneurs struggle with certain more complicated rules which are being imposed, because they lack legal expertise to dissect all regulations and obligations they must account for.

This is completely understandable, as when new rules get implemented, even people experienced in such matters often need to take a long hard look before they can properly process all implemented changes. It is especially hard, because in modern eCommerce changes can happen rather quickly, and a business should adapt fast so as not to lose any profits, or even become liable. So today we will take a look at new regulations regarding eCommerce EU VAT.

Most eCommerce enthusiasts know about the fact that European Commission has planned to introduce new rules for paying VAT for eCommerce from January 1, 2021. Today we will talk more about changes, which will be implemented this summer, and discuss different nuances entrepreneurs should be familiar with in this regard.

What is VAT?

First things first. Addressing our differently experienced readers with varying backgrounds in taxation, let us start with explaining a bit about what VAT is. VAT is a value-added tax, which is essentially a consumption tax based on goods and services’ value, meaning that sellers take it into account while pricing their goods, this way gathering it from buyers and paying tax authorities, and also bears administrative costs associated with these processes.

VAT is an important source of budget revenues. For example, 2021 statistics show that in England VAT brought £134 billion into the budget in the years 2019/2020, which accounted for about 1/6 of the entire income from receipts.

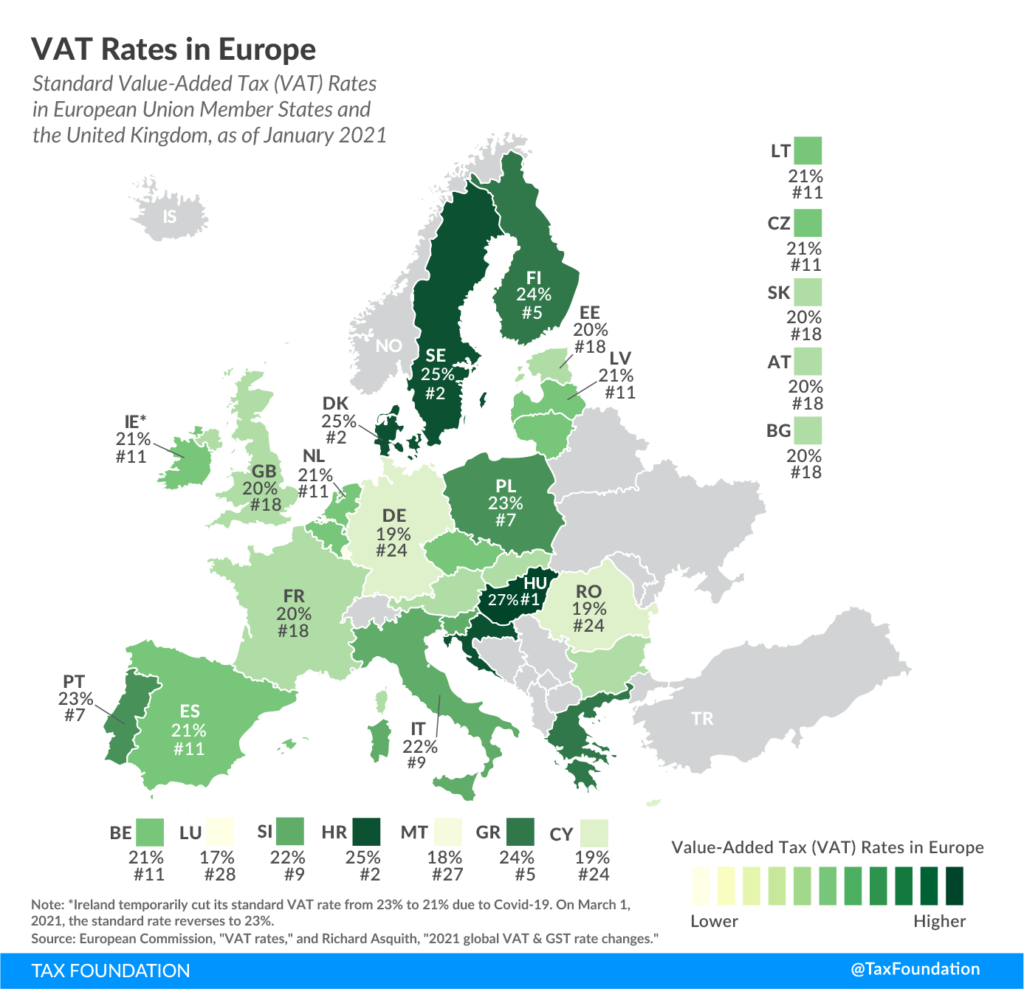

For your convenience, standard EU VAT rates are shown on the map below

Information is provided by Tax Foundation

When selling goods B2C (“business-to-consumer” – sale of goods and services to the end consumer), including drop-shipping, VAT rates that will be applied are determined by the place where goods are delivered.

How will the eCommerce EU VAT initiatives affect business?

Tax authorities of EU countries strive to exercise full control over the observance of a correct calculation of taxes, timeliness, and completeness of making payments in the amount established by tax legislation by all entrepreneurs.

The eCommerce market is actively developing over time, which requires the adaptation of tax legislation, otherwise, losses from incomplete receipts of tax payments will be colossal, which was a case when marketplaces did not require their sellers to comply with tax laws, including VAT registration. This brought losses to the state in the first place, and conditions of fair competition were not observed, meaning that sellers who registered for VAT had prices 20% higher than non-registered competitors.

Despite measures taken regarding proper taxation, member states of the European Union are losing billions in VAT revenues due to tax fraud and insufficiently established tax collection systems.

In this regard, the European Commission has planned to introduce new rules for VAT payment for eCommerce from January 1, 2021, in three areas:

- Launch of OSS (One-Stop-Shop) based on the successful experience of launching a Mini One-Stop-Shop.

- Abolition of privileges for import of goods worth up to €22 and simplification of mechanisms for declaring and paying import VAT for importers of goods.

- Strengthening the liability of marketplaces for fraudulent sellers to pay VAT.

However, on May 8, 2020, due to the outbreak of the Covid-19 pandemic and the precautions taken to protect against it, the European Commission proposed to postpone the introduction of new eCommerce EU VAT rules for for six months.

New rules will apply from 1 of July 2021, rather than 1 January 2021 as previously reported, to give EU member states and businesses time, so they could prepare. Also, recently, the UK has been actively insisting on extending the Brexit transition period up to 2 years due to the economic consequences the epidemic brings.

Let’s take a closer look at the EU’s intentions to modernize and simplify VAT for cross-border eCommerce. This is a priority in work on the EU Digital Single Market strategy. Also, new rules are aimed at combating VAT fraud.

Whether you work in eCommerce, are a customs agent, or provide logistics services, new VAT rules will definitely affect your business.

What are the eCommerce EU VAT innovations

Let’s review each of the directions which will be affected by changes.

Expanding the scope of existing MOSS to One-Stop-Shop for the remote sale of goods from third countries sellers

In 2015, a simplified Mini One Stop Shop (MOSS) system was introduced for declaring and paying VAT for the supply of telecommunications, broadcasting, and electronic services from businesses to end-users in the EU.

From 2021, in accordance with the new eCommerce EU VAT rules, the scope of MOSS will be expanded to One-Stop-Shop (OSS) so that sellers could fulfill their obligations to collect and pay VAT in one of the EU countries by submitting a single EU VAT returns via digital online portal OSS, rather than filing declarations separately in each jurisdiction.

Today sellers collect VAT from the buyer at the place of goods delivery and are required to register VAT when the distance selling threshold is exceeded. Simultaneously with the cancellation of this rule, an OSS system will be introduced through which it will be possible to submit a sales report in the EU countries. The main characteristics of OSS are:

- Modern and simpler VAT administration rules for businesses selling goods and services across borders within the EU.

- Easier access to other eCommerce markets.

- VAT administration costs reduced by 2.3 billion euros per year.

Please note that sellers with stocks in warehouses in different EU member states after VAT for cross-border eCommerce reforms of July 2021, must still register as VAT payers in countries where warehouses with their goods are located. Registrations that were made for non-resident countries still remain.

The purpose of the innovation is to stimulate cross-border eCommerce in the EU by reducing the administrative burden of paying VAT on sellers.

Simplification of reporting and fight against unfair competition in the import of goods.

When talking about the fight against unfair competition, we must mention that the current exemption from VAT on imports to the EU from third countries for consignments of goods with a value not exceeding 22 euros will be canceled. This exclusion contributed to large-scale fraud by sellers from third countries, which deliberately underpriced goods, so they could avoid paying VAT on goods’ imports and gain a competitive advantage over sellers who complied with the law.

Cancellation of current VAT exemption for import of small consignments of goods from third countries suppliers for B2C deliveries, including drop-shipping, will mean that imports of goods in full will be subject to VAT, regardless of their value.

From July 2021, Import One-Stop-Shop (IOSS) system will be introduced to provide information on sales of goods with a value not exceeding €150. Sellers will be obliged to register with IOSS of an EU member state. They will be given a unique IOSS identification number, which is shown on all parcels sent to the EU. During customs clearance of goods, VAT will be declared properly, which will ensure fast clearance. Instead, sellers from third countries will pay import VAT for consignments under €150 using IOSS. It should be noted that IOSS use will not be required. In absence of registration with IOSS, logistics intermediaries can declare and pay VAT for sellers in a country of destination in a simplified manner.

Marketplace control over compliance with tax legislation in the field of VAT and responsibility for collecting and paying VAT for marketplaces.

Today, online entrepreneurs who use marketplaces are obliged to independently calculate their VAT and pay it. In accordance with new VAT rules for cross-border eCommerce, it is planned to in some cases impose tax agent duties on digital trading platforms, so they would collect VAT from buyers and pay it.

In connection with new VAT for cross-border eCommerce reform, marketplaces’ responsibility for sellers’ non-compliance with tax laws will also be strengthened. Marketplaces will need to closely monitor sellers’ transactions so that tax authorities in the buyer’s country could verify that VAT is correctly accounted for.

Information about transactions will have to be stored electronically for at least 10 years after a year transaction took place. Also, the marketplace will be responsible for paying VAT if the information necessary for calculating VAT is distorted by a seller unless it is proven otherwise.

Final Words

Now that you know everything about the upcoming changes in the eCommerce EU VAT regulations, how can you make sure that your clients get high quality items?

Easy, you need to rely on a serious supplier who only sources from some of the top factories and manufacturers in China. Someone like Yakkyofy!

- We can give you back B2B quotes for over 12 million products in real-time, thanks to its image recognition technology.

- We will run Quality Control checks before your items are shipped out to your final customers.

- We offer free storage for your products if you decide to buy even a little stock of them;

- We will fast ship your products to your customers in many countries around the world!

You’re thinking of importing products from China to a custom location?

- We will provide you with a quote comprehensive of all costs, such as shipping and customs, and when sending your products;

- Your products will be accompanied by all the documentation needed to pass through customs and safely arrive at the final destination;

- We can even ship to Amazon FBA locations!

So what are you waiting for?

BIOGRAPHY OF THE AUTHOR

Alison Lee is a writer, as well as a marketing and eCommerce enthusiast. Her attention to detail and ability to comprehensively review information contribute to her writing skills, cumulatively producing informative and easy-to-digest content, featuring pressing modern-day commerce topics. Due to her experience with several international companies that operate in the realm of eCommerce, Alison is well-equipped to share her expertise with her readers. You can get to know her creative writing work at subjecto, where she showcases her academic writing abilities. In her free time, Alison lives cooking, cycling, and traveling.