page for the tenth time today. Still the same message: “Held by customs.” Your customer sent three emails in the last 24 hours. Your chargeback window is closing. Your review average is about to drop.

This isn’t just a logistics hiccup anymore. In 2026, with eliminated duty-free thresholds and aggressive customs enforcement across the EU and US, packages getting stuck at the border has become one of the biggest operational threats to dropshipping businesses.

Let me show you what’s really happening, why it’s happening more frequently now, and the exact steps that actually solve the problem instead of just creating busywork.

Why packages get stuck in customs more often in 2026

Before we talk solutions, you need to understand what changed. Because if you’re operating with 2022 knowledge, you’re fighting yesterday’s battle.

The July 2026 customs reforms eliminated all shortcuts

As of July 1, 2026, the European Union eliminated the €22 duty-free threshold. Every single package entering the EU now requires full customs declaration, IOSS registration, and VAT calculation. No exceptions. No “it’s just a small item” passes.

In the United States, the suspension of the $800 de minimis exemption for Chinese goods means packages that used to sail through now face mandatory inspection and tariff assessment.

What does this mean for you? Customs authorities are processing exponentially more declarations while simultaneously increasing scrutiny. The bottleneck isn’t just bureaucratic anymore. It’s structural.

The most common reasons packages actually get held

Let’s cut through the generic advice and talk about what customs officers are actually looking for when they flag packages.

Incomplete or incorrect EORI numbers. If you’re shipping to the EU without a valid EORI number on the customs declaration, the package gets automatically flagged. Not sometimes. Every time. The system doesn’t make exceptions.

Missing or inconsistent product descriptions. “Gift” or “Sample” or “Accessories” as a product description triggers immediate manual review. Customs wants HS codes, material composition, country of origin, and accurate commercial value.

Undeclared or suspiciously low values. Declaring a smartwatch as $5 to avoid duties? That’s not clever. It’s fraud. And in 2026, customs systems use AI to compare declared values against market databases. When there’s a mismatch, the package gets pulled.

Restricted or prohibited items. Batteries, certain electronics, cosmetics, supplements, anything resembling a weapon, counterfeit goods, items infringing intellectual property. These don’t just get delayed. They get seized.

Incorrect VAT treatment or missing IOSS. If you’re supposed to use IOSS but didn’t, or if the VAT calculation is wrong, customs holds the package and contacts the recipient for payment. Your customer gets hit with unexpected fees. Your brand reputation takes the hit.

The pattern here? Most delays are caused by preventable documentation errors, not random bad luck.

(Learn how IOSS compliance prevents customs delays and why accurate documentation is non-negotiable in 2026.)

What to do immediately when a package gets stuck

You’ve got a stuck package. Customer is messaging you. Clock is ticking. Here’s the action sequence that actually works.

Step one is verify the actual status, not just the tracking message

“Held by customs” on a tracking page doesn’t tell you the real story. Contact the carrier directly. Get the specific reason code. Is it awaiting documentation? Is it flagged for inspection? Is there a duty payment required?

You cannot solve a problem you don’t understand. Generic tracking status is not enough information to act on.

Step two is gather all documentation before contacting customs

Customs authorities are processing thousands of packages. They don’t have time for back-and-forth email chains. When you contact them, have everything ready.

You need the commercial invoice showing accurate product description, value, and HS code. You need proof of EORI registration if shipping to EU. You need proof of IOSS enrollment if applicable. You need the tracking number, customs declaration number, and recipient details.

Walk into the conversation prepared or don’t walk in at all.

Step three is submit missing or corrected documentation immediately

If customs is waiting for information, every hour of delay extends the hold. Submit corrected documentation through the official channels, not via email to random addresses you found online.

Most customs authorities now have online portals for document submission. Use them. Follow up with reference numbers. Keep records of every submission.

Step four is communicate proactively with your customer

This is where most sellers fail. They go silent hoping the problem resolves itself. Meanwhile, the customer is Googling “how to file chargeback” and writing the 1-star review in their head.

Tell them exactly what’s happening. Tell them what you’re doing about it. Give them a realistic timeline. Offer proactive solutions like partial refunds or replacement shipments if the delay exceeds a certain threshold.

Transparency doesn’t eliminate the problem, but it prevents it from destroying your customer relationship.

When to accept the package is lost and move on

Sometimes packages don’t just get delayed. They get seized, returned, or lost in bureaucratic limbo for weeks.

You need a decision framework for when to stop fighting and when to cut losses.

If it’s been more than 15 days with no movement

At 15 days stuck in customs with zero progress updates, the probability of successful delivery drops below 30% based on 2026 data. Your customer has likely already filed a dispute. Your review window is closed.

At this point, issue a refund or send a replacement. Don’t wait for the customs miracle that’s not coming.

If customs explicitly states the item is prohibited or seized

You’re not getting it back. Stop trying. Refund the customer, analyze why it happened, and fix your sourcing or documentation process so it doesn’t happen again.

If the duty or storage fees exceed the product value

Some customers get hit with €40 in customs fees on a €30 product. They refuse to pay. The package sits in customs, accruing storage fees. At some point, the carrier will return it to sender or destroy it.

If retrieval costs more than replacement, just send a new one through a compliant channel.

(Discover how professional fulfillment partners handle customs issues and why prevention is cheaper than resolution.)

How to prevent customs delays in the first place

Here’s the uncomfortable truth: if you’re regularly dealing with stuck packages, the problem isn’t bad luck. It’s bad process.

Use IOSS registration for all EU shipments

IOSS allows you to collect and remit VAT at the point of sale. When properly registered, packages entering the EU get priority customs clearance because the tax is already handled.

No IOSS? Your packages go into the manual processing queue. Delays are virtually guaranteed.

This isn’t optional anymore. It’s operational baseline.

Ensure accurate HS codes on every shipment

HS codes determine duty rates, restricted item classification, and customs processing requirements. Wrong code means wrong duty calculation means package gets flagged.

If you’re dropshipping from AliExpress and letting random suppliers fill in customs declarations, you have zero control over HS code accuracy. This is why professionals use sourcing agents who manage documentation centrally.

Never undervalue products on customs declarations

I know the temptation. Lower declared value means lower duties. Except customs systems now cross-reference declared values against product databases, competitor pricing, and historical shipping data.

When the system flags a mismatch, your package gets pulled for manual inspection. What you “saved” in duties you now lose in delays, customer complaints, and potential account penalties.

Declare accurate commercial value. Every time.

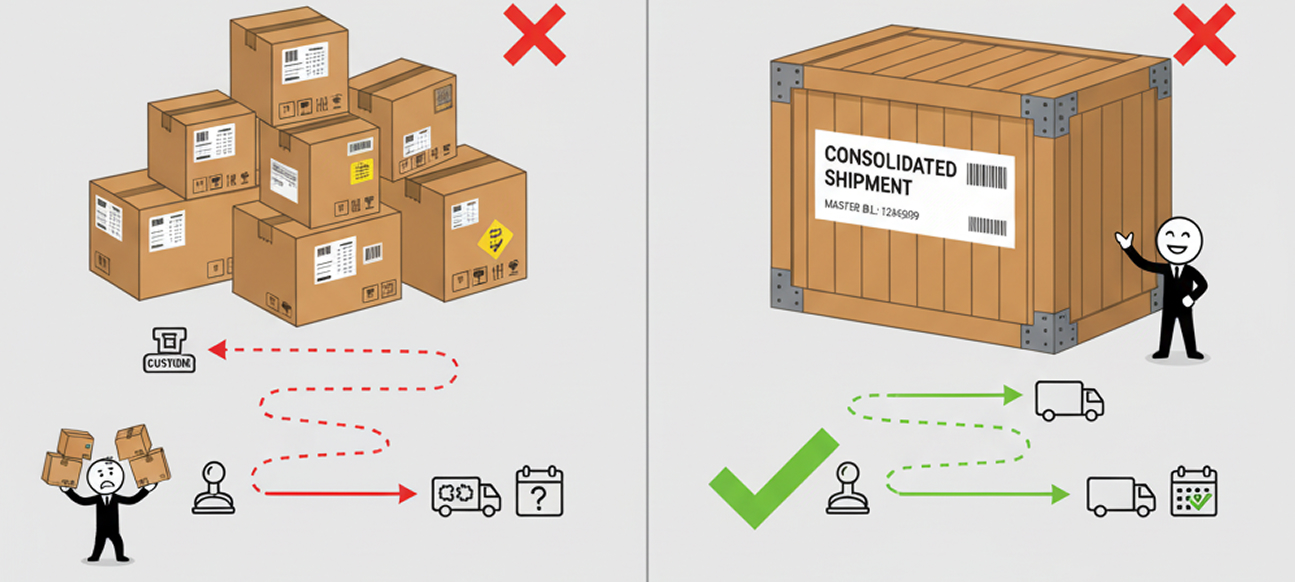

Consolidate shipments when possible

If a customer orders three items and you send three separate packages from three different suppliers, you’ve just tripled your customs risk exposure. Three declarations. Three chances for errors. Three potential delays.

Consolidation into a single package with unified customs documentation reduces risk, cuts shipping costs, and improves customer experience.

This is why the hybrid fulfillment model using Virtual Warehouse is becoming standard for serious sellers.

(See how consolidated shipping reduces customs delays by 70% and improves delivery reliability.)

The tools and partners that actually prevent customs nightmares

You can’t manually manage customs compliance at scale. You need infrastructure.

Automated IOSS and customs documentation systems

Platforms like Yakkyofy support IOSS compliance by attaching your IOSS number to customs declarations automatically. You enter your registration code once in the dashboard, from that point, every EU shipment includes the correct documentation.

Every order gets the correct paperwork generated in real-time based on destination country requirements.

No manual data entry. No forgotten fields. No human error causing package holds.

Sourcing agents with customs expertise

A good sourcing agent doesn’t just find products and ship them. They understand customs regulations, maintain relationships with compliant freight forwarders, and use pre-cleared logistics channels that minimize border delays.

They’re not just middlemen. They’re insurance against the customs chaos that kills amateur operations.

Special Line logistics with pre-cleared customs

Special Lines are proprietary logistics networks that pre-clear customs in batches before packages even arrive at the border. Shipments move through dedicated channels with priority processing.

This is how professionals achieve 5-8 day delivery globally while manual dropshippers are still waiting for packages to clear customs.

Different game. Different results.

(Explore how Special Line logistics bypasses standard customs delays and why speed is now a competitive requirement.)

What happens if you ignore customs compliance in 2026

Let’s talk consequences because apparently “follow the rules” isn’t motivating enough for some sellers.

Financial penalties and account suspension

Repeated customs violations can result in carrier account suspension, customs authority fines, and VAT authority penalties. In the EU, incorrect IOSS usage can trigger audits and retroactive tax assessments.

You’re not just losing one package. You’re risking your entire operation.

Chargebacks and destroyed customer lifetime value

When customers pay unexpected customs fees, they file chargebacks. When packages sit in customs for weeks, they dispute transactions. Your chargeback rate increases. Payment processors flag your account. Your costs per transaction increase.

One customs nightmare can cost you ten future customers.

Competitive disadvantage you can’t recover from

While you’re dealing with stuck packages and angry customers, your competitors using compliant infrastructure are delivering in 5 days with zero customs drama. They’re getting 5-star reviews. Building loyalty. Scaling.

You’re fighting fires. They’re growing businesses.

The gap widens every day you operate without proper customs management.

The bottom line on stuck packages in 2026

Customs delays are no longer occasional inconveniences. They’re systematic risks built into the new global trade environment.

If you’re still manually ordering from AliExpress, hoping suppliers fill out customs forms correctly, and reacting to problems after they explode, you’re operating a fragile business on borrowed time.

The solution isn’t working harder. It’s working with infrastructure designed for 2026 compliance requirements.

Automate customs documentation. Use IOSS registration. Partner with sourcing agents who understand international trade regulations. Ship through pre-cleared logistics channels.

Because in 2026, the difference between a stuck package and an on-time delivery isn’t luck. It’s process.

Your customers don’t care about customs complexity. They care about whether their order arrives when promised. Build operations that deliver on that promise, or watch competitors take your market share.

The choice is that simple.