Your customer just sent you an angry email. They ordered a $35 product from your store. It arrived after 14 days. The delivery driver demanded an additional $22 in customs fees and import tax before handing over the package.

Now they want a full refund. They’re threatening a chargeback. They’ve already left a 1-star review mentioning “hidden fees” and “scam.”

You didn’t scam anyone. you also didn’t account for how international import tax enforcement has tightened in recent years and that ignorance just cost you a customer

Let me show you exactly what’s happening, why manually ordering from AliExpress is now a liability, and how professional sellers are handling import taxes without destroying their customer relationships.

What actually changed with AliExpress import taxes in 2026

If you’re still operating with 2022 knowledge about duties and taxes, you’re about to get blindsided. The entire global trade framework shifted, and AliExpress sellers are caught in the crossfire.

The EU eliminated the €22 duty-free threshold completely

Since July 2021, the EU eliminated the €22 duty-free threshold. Every package entering the EU requires VAT collection and customs declaration regardless of value.

Every single package entering the EU now triggers VAT collection, customs declaration requirements, and potential duty assessment regardless of value.

That $15 phone case? Taxable. That $8 keychain? Taxable. There are no minimums. There are no exceptions.

The US suspended the $800 de minimis for Chinese goods

The United States historically allowed packages valued under $800 to enter duty-free under Section 321 de minimis exemption. This made direct-from-China shipping economically viable for small businesses.

US de minimis rules for Chinese goods have been subject to significant regulatory changes. Verify current tariff requirements with a customs broker before importing.

What was once a predictable cost structure is now a minefield of variable tariffs, mandatory customs declarations, and unpredictable delays.

Other countries followed similar paths

Canada reduced its duty-free threshold. Australia tightened enforcement. The UK implemented stricter VAT collection on low-value imports. The global trend is unanimous and irreversible.

The casual dropshipping model that relied on tax arbitrage and enforcement gaps is officially dead.

Discover why 2026 customs reforms ended the old dropshipping model and what replaced it.

How AliExpress import taxes actually work in 2026

Let’s break down the mechanics so you understand what’s hitting your customers and why.

VAT is calculated on total value including shipping

In the EU, VAT rates range from 19% to 27% depending on country. It’s calculated on the total transaction value, which includes product cost, shipping fees, and insurance.

If your customer in Germany orders a $30 product with $8 shipping, the VAT base is $38. At Germany’s 19% rate, that’s an additional $7.22 in tax.

But here’s the problem: if you didn’t collect this at checkout and handle it via IOSS, your customer pays it at delivery plus a customs handling fee of €3-€6.

So they paid you $38. Then the delivery driver demands another $12-$15. That’s a 32% surprise price increase at their doorstep.

How do you think that conversation goes?

Duties depend on product category and origin

Beyond VAT, many products face additional import duties based on their HS code classification. Electronics, textiles, shoes, and certain accessories commonly face duties ranging from 5% to 20%.

These are calculated separately from VAT and stack on top of it.

If you’re dropshipping a $50 pair of sneakers from China to France, you’re looking at roughly 12% duty plus 20% VAT. That’s $6 in duty and $11.20 in VAT, for a total of $17.20 in import charges.

If your customer doesn’t know this is coming, you’ve just lost that customer forever.

Handling fees compound the pain

Even when taxes are legitimate and correctly calculated, carriers add handling fees for processing customs declarations. These range from €3 to €15 depending on the carrier and destination country.

On a $25 product, a €6 handling fee is a 24% hidden surcharge. Customers don’t see this as “logistics reality.” They see it as your failure.

Why manually ordering from AliExpress guarantees tax problems

Here’s what most sellers don’t understand: when you manually order from AliExpress and ship to your customer, you have zero control over customs documentation, declared values, or tax handling.

AliExpress sellers often misdeclare values to help you avoid duties

This sounds helpful. It’s actually catastrophic.

Many AliExpress sellers will declare a $50 product as $10 to help it slip through customs with lower duties. This is fraud. It’s illegal. And in 2026, customs authorities use AI systems that compare declared values against market databases.

When there’s a mismatch, the package gets flagged, held, and inspected. Your customer faces delays, potential seizure, and definitely no smooth delivery experience.

You wanted to save $5 in duties. You just cost yourself a customer and a potential customs violation on your account.

You can’t control whether IOSS is used correctly

IOSS, the Import One-Stop Shop, is the EU’s system for collecting VAT at the point of sale rather than at delivery. When properly used, packages clear customs instantly with no fees at delivery.

But if you’re ordering from random AliExpress sellers, you have no idea if they’re IOSS-registered, if they’re using their IOSS number correctly, or if the documentation is accurate.

Most aren’t. Most don’t. Your package ends up in the manual processing queue. Your customer pays unexpected fees. Your brand takes the hit.

Each supplier ships separately with different documentation

If your customer orders three items and they come from three different AliExpress sellers, you’ve got three separate shipments with three different customs declarations.

Three chances for errors. Three separate tax assessments. Three different delivery experiences. It’s chaos dressed up as a business model.

Professional operations consolidate shipments, unify customs documentation, and ensure consistent tax handling. Manual AliExpress ordering does the opposite.

Learn why consolidated shipping eliminates tax surprises and improves customer experience.

What professional sellers are doing instead

The operators scaling past six figures aren’t playing customs roulette. They’re using infrastructure designed for 2026 compliance.

They use IOSS registration to collect VAT at checkout

IOSS allows you to collect VAT when the customer places the order, remit it to EU authorities, and ensure packages clear customs with no fees at delivery.

This requires IOSS registration, proper integration with your checkout system, and logistics partners who know how to process IOSS shipments correctly.

When done right, your EU customers pay the correct taxes upfront and receive their packages with zero surprises. You look like a professional brand. They become repeat customers.

They work with sourcing agents who handle customs documentation

Professional sourcing agents don’t just ship products. They manage customs compliance, ensure accurate HS code classification, handle duty calculations, and work with carriers who understand IOSS processing.

They’re not an extra cost. They’re insurance against the customs chaos that kills amateur operations.

How Yakkyofy Handles IOSS & VAT

When shipping to the EU, you have two primary options for IOSS compliance:

Option 1: Use your own IOSS number (recommended).

Register to obtain your own IOSS number through the dedicated EU portal if your company is based in the EU, or through a registered intermediary if your company is based outside the EU. Once you have your IOSS number, you can enter it directly into your Yakkyofy dashboard. From that moment on, all shipments to the EU for goods valued under €150 will automatically use your IOSS number, and you will not see any additional cost per order.

This is the approach we recommend for established dropshipping businesses. It provides direct visibility of VAT through the EU portal and allows you to maintain compliance and full control.

Option 2: Use the forwarder’s IOSS.

This is a service offered by some shipping providers, who cover IOSS using their own code as an additional service. A small extra fee will be applied to each order, which also includes the cost of using the forwarder’s IOSS. This can be a practical solution if you are waiting for your IOSS to be approved or if you want to test the service.

In both cases, the Yakkyofy operations team can assist you with your orders and with correctly filling in your data on the platform.

For questions regarding VAT obligations, registration requirements, and reporting, we always recommend consulting a qualified tax advisor. Requirements may vary depending on your company structure, country of establishment, sales volumes, and specific circumstances.

They use DDP shipping terms when appropriate

DDP, Delivered Duty Paid, means you as the seller pay all duties and taxes. The customer sees one price at checkout and pays nothing at delivery.

For certain markets and product categories, DDP is the only competitive option. Your customers expect Amazon-like simplicity. One price. Fast delivery. No surprises.

If you can’t offer that, someone else will take your market share.

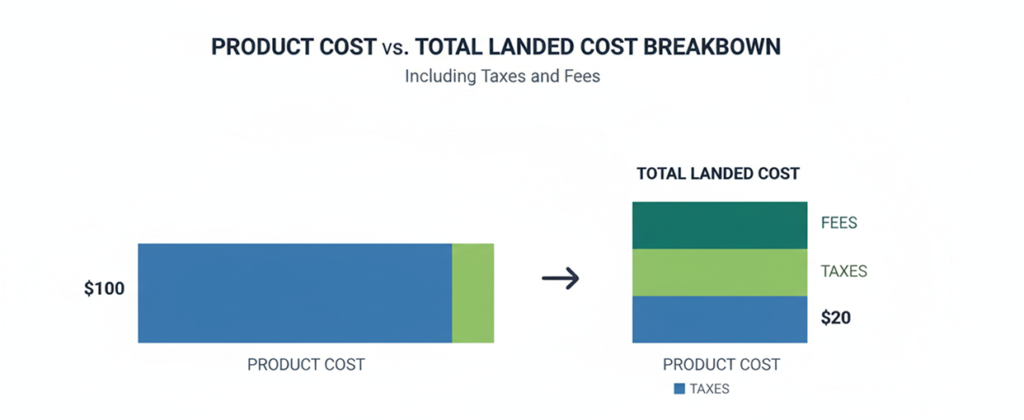

They price products with tax implications built in

Professionals don’t ignore taxes and hope customers won’t notice. They calculate total landed cost including VAT, duties, and handling fees, then price accordingly.

This means higher prices than competitors who are ignoring taxes. But it also means sustainable margins, happy customers, and no chargeback disasters.

You can compete on price with unsustainable practices or compete on experience with professional operations. Only one of those scales.

How to calculate and handle AliExpress import taxes correctly

Let’s get tactical. Here’s exactly what you need to do if you’re shipping products internationally.

Step one is understand your destination country requirements

Every market has different rules. EU requires IOSS for VAT collection. US has variable tariff schedules. UK has separate VAT registration requirements. Canada has different thresholds.

You cannot operate internationally without understanding destination-specific regulations. Ignorance isn’t a defense. It’s a liability.

Step two is classify products with correct HS codes

HS codes determine duty rates, restricted item classification, and customs processing requirements. Wrong code means wrong duty calculation means package delays or customer fees.

If you’re dropshipping random products without knowing their HS codes, you’re gambling with every shipment.

Professional operations maintain HS code databases and ensure accurate classification on every customs declaration.

Step three is calculate total landed cost before setting prices

Total landed cost includes product cost, shipping fees, VAT, duties, and handling fees. This is what your customer effectively pays, either upfront or at delivery.

Calculate this for your primary markets. Price products accordingly. Don’t pretend taxes don’t exist because you’re not collecting them. They exist. Your customers pay them. If they’re surprised by them, they blame you.

Step four is integrate IOSS at checkout for EU sales

If you’re selling to EU customers, IOSS integration is non-negotiable. Collect VAT at checkout, remit it properly, ensure your logistics partner processes shipments with your IOSS number.

This sounds complex. It is, if you’re doing it manually. That’s why professionals use platforms that handle this automatically.

Step five is work with compliant logistics partners

Your carrier needs to understand IOSS, know how to process customs declarations correctly, and have infrastructure for duty pre-payment when needed.

Random AliExpress sellers shipping via untracked ePacket don’t meet this standard. Professional sourcing agents with established logistics networks do.

See how automated tax compliance eliminates surprises and why professional fulfillment is now baseline for competitive operations.

What happens if you ignore import taxes in 2026

Let’s talk consequences because apparently following regulations isn’t motivating enough for some sellers.

Your customers get hit with unexpected fees and destroy your reputation

This is the immediate consequence. Customer orders $40 product. Delivery driver demands $18 in fees. Customer is shocked, angry, and feels scammed.

They file a chargeback. They leave a 1-star review. They tell friends to avoid your store. They post on social media about the “hidden fees.”

One tax surprise can cost you ten future customers.

Your chargeback rate increases and payment processors take action

When multiple customers dispute charges because of unexpected delivery fees, your chargeback rate increases. Payment processors like Stripe and PayPal flag accounts with elevated dispute rates.

You face higher per-transaction fees. You might face account limitations or suspension. You definitely face increased scrutiny on future transactions.

You face potential customs violations and penalties

Systematic misdeclaration of values, incorrect use of IOSS numbers, or shipping prohibited items can result in customs authority penalties, carrier account suspension, and even legal action in extreme cases.

You’re not just losing sales. You’re risking your entire operation.

You cannot compete with sellers who handle taxes correctly

While you’re dealing with angry customers and chargebacks, your competitors using compliant infrastructure are delivering smooth experiences, building loyalty, and scaling.

They collect taxes upfront. Their packages clear customs instantly. Their customers are happy. Their reviews are excellent.

You’re fighting fires. They’re growing businesses. The gap widens every day.

The alternatives to risky AliExpress tax situations

You have options. You just need to understand them and make informed decisions.

Use platforms with built-in tax compliance

Professional fulfillment platforms handle IOSS registration, VAT calculation, duty pre-payment, and customs documentation automatically. You sell. They handle compliance.

This isn’t expensive infrastructure for enterprise companies. This is baseline functionality for anyone serious about international e-commerce in 2026.

Partner with sourcing agents who manage customs end-to-end

A good sourcing agent doesn’t just find products and ship them. They understand international trade regulations, maintain customs expertise, and work with compliant logistics networks.

They’re not middlemen adding unnecessary costs. They’re specialists preventing expensive mistakes.

Consider fulfillment centers in destination markets

For high-volume sellers, maintaining inventory in EU, US, or other key markets eliminates import taxes entirely on individual shipments. You import in bulk, pay duties once, then ship domestically.

This requires more capital and infrastructure, but it’s the ultimate solution for scale and customer experience.

Be transparent about taxes at checkout

If you cannot or will not handle taxes through IOSS or DDP, at minimum warn customers clearly that additional fees may apply at delivery.

This won’t prevent all complaints, but it’s better than surprising people. Transparency builds trust even when the news isn’t perfect.

Discover when to transition from dropshipping to hybrid inventory models and why scaling requires infrastructure evolution.

The bottom line on AliExpress import taxes in 2026

Import taxes aren’t optional. They’re not “someone else’s problem.” They’re built into the cost structure of international e-commerce, and your customers are paying them whether you acknowledge it or not.

The only question is whether you handle them professionally or let them explode at delivery.

If you’re still manually ordering from AliExpress, hoping suppliers handle documentation correctly, and reacting to tax disasters after they happen, you’re not running a business. You’re running a compliance crisis waiting to happen.

The solution isn’t complicated. Use IOSS for EU shipments. Work with partners who understand customs. Calculate total landed cost. Price transparently. Ship through compliant channels.

Because in 2026, the difference between a smooth delivery and a customer nightmare isn’t luck. It’s infrastructure.

Your customers don’t care about tax complexity. They care about whether they get what they ordered for the price they expected. Build operations that deliver on that promise, or watch competitors take your market share.

The choice is exactly that simple.

This guide is for informational purposes only and does not constitute professional tax or legal advice. EU/UK VAT and IOSS regulations are subject to change. It is recommended that you consult a certified tax and legal advisor for your specific business structure.

Start Your dropshipping business

Do I have to pay import tax on AliExpress orders?

Yes. Since 2021, EU regulations require VAT on all imports regardlessof value. Other markets have implemented similar changes. Low-value items are no longer exempt in most major e-commerce destinations.

How much is import tax from AliExpress to EU countries?

VAT ranges from 19% to 27% depending on country, calculated on total value including shipping. Additional duties of 0-20% may apply depending on product category. Handling fees add €3-€15 per package.

Can I avoid AliExpress import taxes legally?

No. You cannot avoid taxes. But you can manage them professionally through IOSS registration (collecting VAT at checkout) or DDP shipping (paying duties yourself), ensuring customers face no surprise fees at delivery.

What is IOSS and do I need it?

IOSS (Import One-Stop Shop) allows you to collect EU VAT at checkout and remit it to authorities, enabling packages to clear customs without fees at delivery. If you sell to EU customers, this is now essential for competitive operations.

Why did my customer get charged extra fees if I already paid for shipping?

Shipping cost and import taxes are separate. If you didn’t collect VAT via IOSS or arrange DDP shipping, your customer pays taxes plus handling fees at delivery regardless of what you charged for shipping.